Bond investing was the norm in Billy’s time, as we saw last time, because investors wanted cash every year. If an investment didn’t pay cash, they had little use for it.

Bond investing was the norm in Billy’s time, as we saw last time, because investors wanted cash every year. If an investment didn’t pay cash, they had little use for it.

There’s another reason investors liked bonds. Bonds are usually issued at $1,000 each. Investors like uniformity, because it makes it easy to compare one bond issue to another.

When stocks came along as a type of investment, it had to compete for investors’ dollars against bonds. To attract investors’ attention, stocks needed two things:

- An annual cash income, comparable to bonds’ interest

- Uniformity in issuance, like bonds’ $1,000 unit value

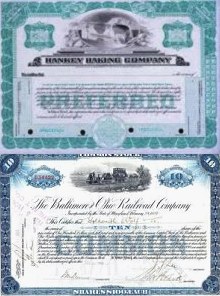

The earliest stocks, therefore, were almost always issued at $100 par value, and paid a guarateed annual dividend, just like bond interest. They were called preferred stock (as opposed to common stock).

So, what’s the difference between preferred and common stock?

Preferred Stock

We don’t see too much preferred stock today, but back then it was an essential part of any stock offering, the first thing prospective investors looked at. Preferred stock has several unique attributes:

1. Fixed Dividend

A preferred stock pays a fixed dividend each year, much like a bond pays interest. The annual dividend on 7 percent preferred stock will always be $7 (7 percent of $100). Investors know what they will get.

Because the dividend is fixed, preferred stock prices don’t usually go up or down, except when investors fear for the health of the company, when the price of preferred stock will drop, sometimes precipitously. When Billy lost control of General Motors, its preferred stock went as low as $40.

2. Guaranteed Dividend

Investors are guaranteed to receive the dividend as long as the company is alive and able to make the payment. Should the company skip a dividend, it usually accumulates and gets caught up once the company returns to financial health.

3. Liquidation Preference

Should the company get liquidated or taken over, preferred stockholders are paid out before common stockholders.

4. No Vote

Most of the time, only common stockholders can vote for things like who is on the board.

Common Stock

Aptly named, this is the most common form of stock we know today. The stock you own in your 401(k) plan almost always is common stock. Its main attributes are:

1. No Floor or Ceiling

If a company does well (like Apple or Berkshire Hathaway today) the sky is the limit for the stock price. On the other hand, if it messes up (like Enron or Circuit City) the price goes to zero.

In Billy’s day common stock was regarded as too risky for “respectable” investors… but it is what made the people who owned it rich when the company prospered (as Billy’s usually did).

2. Control

Owners of common stock control the company, its board, its major decisions and so forth. Preferred stockholders have no say.

In the final installment of this miniseries, we’ll see how Billy Durant and his peers put this into practice, and how it played a pivotal role in his dramatic comeback.