Billy Durant started companies like kids grab candy on Halloween, and Comeback! mentions several. Entrepreneurs like Bill Gates, Steve Jobs and, yes, Billy Durant, all made their wealth not from their salaries but from their stock. The final act of the Billy Durant comeback centers around stock, so this mini-series of posts might help you understand the nuances of what transpired.

Billy Durant started companies like kids grab candy on Halloween, and Comeback! mentions several. Entrepreneurs like Bill Gates, Steve Jobs and, yes, Billy Durant, all made their wealth not from their salaries but from their stock. The final act of the Billy Durant comeback centers around stock, so this mini-series of posts might help you understand the nuances of what transpired.

First we’ll look at how investors in general viewed stock in the late 1800s and early 1900s (hint: not nearly as favorably as today). Then we’ll look at the difference between preferred and common stock, because that made a difference in Billy’s comeback. And finally we’ll look at proxies, because that was the clincher. (Often is today, too.)

Investors’ Views

Investments have always been sold more than bought. Even when you invest through your 401(k) plan, someone will show up (at least initially) to sell you on how lovely a thing this is going to be. Before the advent of E-Trade and other online brokers, you had to field calls from your broker peddling the latest hot stock, mutual fund or bond.

Back in the early 1800s railroads took the country by storm. Railroads require vast amounts of capital and their creators turned to investors to raise the money. Initially most was raised through bonds. Investors of the day loved bonds, because they are easy to understand: in return for your investment you get a set interest payment every quarter, and at some predetermined date you get all your money back. How nice is that?

But there were tens of railroads, if not hundreds, to choose from. Which one do you invest in? It didn’t take long for promoters to learn they had to sell their investments to the investors of the day: wealthy families and investment houses. And the most aggressive sales team usually won. (Still do.)

Alignment

When you invest, you fear losing your money, but you also want to make lots. Same with those people. Investing is the pinnacle of those two emotions so closely related, yet so conflicting: fear and greed

Investors a century or two ago became used to investing in bonds. Most got repaid and, most importantly, a healthy secondary market developed where you could unload your investments before they were repaid, or buy ones long after their initial issuance.

Stock is a different kind of investment. It never gets repaid like bonds, so the only way you can get your money back is when you sell it on the open market. If, like the railroads of the day, you wanted to sell your stock as an investment, you had to align it as closely as you could to what your prospects understood.

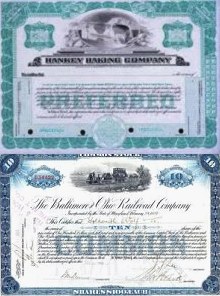

It is therefore no surprise that the most popular form of stock back then was preferred stock, because it is structured very much like a bond.

What is preferred stock exactly? The next post wanted you to ask. 🙂